Laos has unveiled an ambition plan to transform itself into a central hub for gold trade and refining in Asia by 2030, led by the Lao Bullion Bank. This initiative is intended to strengthen the financial stability of the nation and to increase its status in the worldwide market for priceus metals.

During a strategic Meoting on 2 May, the Chief Executive Officer of LBB, Chanthone Setthixay, described the bank’s vision to establish Laos as a leader in the priceus metals sector. The plan includes the development of extensive gold training platforms, refining options and safe storage solutions, in accordance with international standards to withdraw both regional and global investors.

The Lao Bullion Bank, officially launched in December 2024, is an important step in the economic strategy of the country. The bank’s establishment of the bank is a cooperation effort between the LAO government and PTL possession, whereby the government has a 25% interest and PTL possesses that the Remaing has 75%. This partnership underlines an obligation to improve the gold reserves of the country and to stabil the local currency.

Since its foundation, LBB has introduced various services, including Gold Deposit Battery, Loans supported by Gold Collateral and Gold Vinging Machines. These offers are intended to integrate gold deeper into the financial system, so that citizens offer alternative investment options and contribute to economic resilience.

To strengthen its position in the regional market, LBB, LBB, strategic partnerships arrived at important players in the industry. In October 2024, the bank signed at the Memorandum of achieving the Singapore Bullion Market Association, aimed at knowledge exchange and cooperation with regulations to improve the Bullion market infrastructure of LAOS. In addition, a partnership with Stonex APAC was set up for light technological expertise and she developed new financial products tailored to the priceus metals sector.

In March 2025, LBB further expanded its network by working together with Samlane Jewelry, a local prominent Golden Retailer. This cooperation is intended to standardize gold trading practices at the country and to facilitate more flexible transactions for investors and consumers. As part of this initiative, a promotion campaign was launched, which offers incentives to customers who deposit gold at the bank, which encourages public participation in the formal gold market.

The bank’s efforts are also aimed at refining unparalleled golden ores, so that they are converted into valuable assets that can contribute to the national budget and red service. By doing this, Laos tries to maximize the value of its natural resources, sustainable economic growth and financial independence.

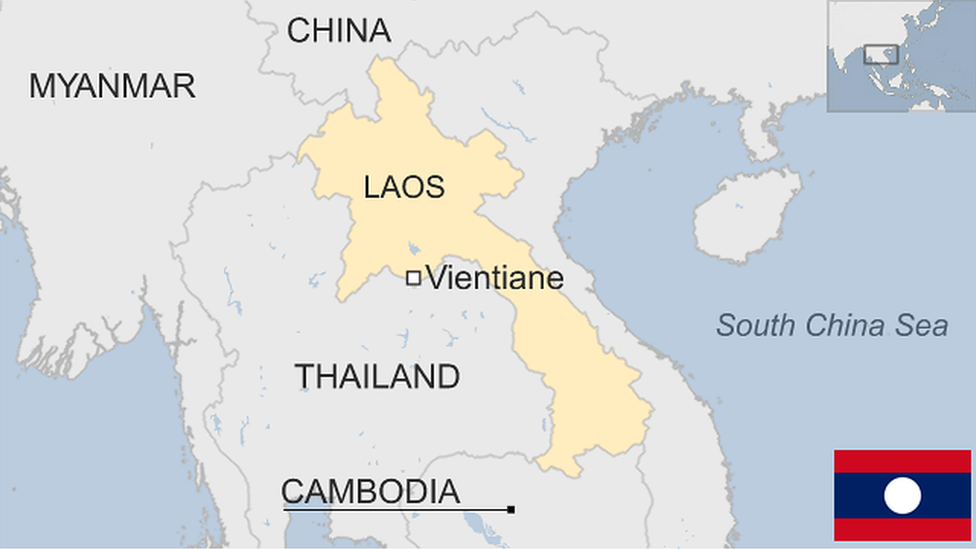

The LBB location and its subsequent initiatives reflect a broader regional strategy to integrate Laos more fully into the global financial system. By positioning himself as a central player on the priceus metals market, Laos wants to attract foreign investments, improve its economic stability and offer citizens diversified financial services.